In today’s rapidly evolving financial landscape, technology plays a crucial role in shaping the way we manage our finances. As traditional banking methods give way to digital solutions, the demand for fintech software development companies has skyrocketed. These companies are at the forefront of revolutionizing the financial industry, offering innovative solutions that enhance efficiency, security, and accessibility.

A fintech software development company specializes in creating software applications tailored to meet the unique needs of financial institutions, businesses, and consumers. Their expertise lies in developing cutting-edge technologies such as mobile banking apps, online payment gateways, blockchain solutions, robo-advisors, and much more.

One of the key advantages of partnering with a fintech software development company is their deep understanding of both finance and technology. They possess a comprehensive knowledge of financial systems and regulations along with expertise in coding languages and software development processes. This unique combination enables them to develop robust and secure applications that comply with industry standards while delivering seamless user experiences.

Fintech software development companies also leverage emerging technologies to drive innovation within the financial sector. For instance, artificial intelligence (AI) and machine learning algorithms are being used to automate tasks like fraud detection, credit scoring, and investment analysis. These advancements not only streamline processes but also enhance accuracy and reduce human error.

Furthermore, these companies understand the importance of data protection and employ stringent security measures to safeguard sensitive financial information. They implement encryption protocols, multi-factor authentication systems, and regularly update their software to address potential vulnerabilities. By prioritizing security at every stage of development, they instill trust among users who rely on their applications for their financial transactions.

Collaborating with a fintech software development company offers numerous benefits for businesses seeking to stay competitive in the ever-evolving digital age. By embracing technological advancements in finance, organizations can streamline operations, improve customer experiences, expand their reach globally, and gain a competitive edge.

In conclusion, fintech software development companies are instrumental in driving the transformation of the financial industry. Their expertise in finance and technology allows them to develop innovative solutions that empower businesses and consumers alike. As the demand for digital financial services continues to grow, these companies will play a crucial role in shaping the future of finance through their cutting-edge software applications.

Frequently Asked Questions: Fintech Software Development Company Services, Experience, Cost, and More

- What services does your fintech software development company offer?

- How experienced is your team in developing fintech solutions?

- What is the cost of working with your fintech software development company?

- How long does it take to develop a custom fintech solution?

- What technologies do you use for developing fintech solutions?

- Do you provide ongoing maintenance and support for developed solutions?

- Are there any additional fees or charges associated with the development process?

- Can I see some examples of successful projects that have been completed by your team?

What services does your fintech software development company offer?

Our fintech software development company offers a wide range of services to cater to the diverse needs of our clients in the financial industry. Here are some of the key services we provide:

- Custom Software Development: We specialize in developing tailor-made software solutions that align with our clients’ specific requirements. Whether it’s a mobile banking app, a trading platform, or a digital wallet, we have the expertise to create robust and scalable applications from scratch.

- Blockchain Solutions: We harness the power of blockchain technology to build secure and transparent financial systems. Our team develops blockchain-based applications such as smart contracts, decentralized finance (DeFi) platforms, and cryptocurrency wallets.

- Payment Gateway Integration: We enable seamless online payment experiences by integrating payment gateways into websites and applications. Our expertise covers popular payment gateways, such as PayPal, Stripe, and Braintree, ensuring secure transactions for businesses and their customers.

- Data Analytics and Business Intelligence: We help financial institutions leverage data analytics to gain valuable insights into customer behavior, risk assessment, fraud detection, and more. Our team develops advanced analytics solutions that empower businesses to make data-driven decisions.

- Robo-Advisory Solutions: We develop automated investment platforms that utilize artificial intelligence algorithms to provide personalized investment advice based on user preferences and risk profiles. These robo-advisory solutions enhance efficiency and accessibility in wealth management.

- Security Solutions: As data security is paramount in the financial industry, we offer comprehensive security solutions to protect sensitive information from cyber threats. This includes implementing encryption protocols, multi-factor authentication systems, intrusion detection systems (IDS), and regular security audits.

- API Development and Integration: We develop APIs (Application Programming Interfaces) that enable seamless integration between different financial systems or third-party services. This allows businesses to enhance their offerings by connecting with external platforms or providing access to their services through APIs.

- Cloud-Based Solutions: We leverage cloud computing technologies to develop scalable and flexible applications that can adapt to changing business needs. Our cloud-based solutions ensure high availability, data redundancy, and cost-efficiency for our clients.

These are just a few examples of the services we offer as a fintech software development company. We work closely with our clients to understand their specific requirements and deliver innovative solutions that drive their digital transformation in the financial industry.

How experienced is your team in developing fintech solutions?

Our team has extensive experience in developing fintech solutions. We have a team of experienced software engineers, data scientists, and financial experts who have worked on a variety of projects in the financial technology space. Our team has developed products for banks, financial institutions, and major payment networks. Additionally, we have experience in developing blockchain-based solutions for digital assets and tokenization.

What is the cost of working with your fintech software development company?

The cost of working with our fintech software development company depends on the project scope and complexity. We offer competitive rates and packages tailored to each client’s specific requirements. Please contact us for a quote.

How long does it take to develop a custom fintech solution?

The development timeline for a custom fintech solution can vary depending on various factors such as the complexity of the project, the specific requirements, and the size of the development team. Typically, developing a custom fintech solution can take anywhere from a few months to over a year.

The initial phase of development involves gathering requirements, conducting market research, and creating a comprehensive project plan. This phase can take several weeks or even months, depending on the scope of the project and the availability of required resources.

Once the planning phase is complete, the actual development process begins. This involves designing the user interface (UI) and user experience (UX), coding backend functionalities, integrating APIs (Application Programming Interfaces), implementing security measures, and conducting rigorous testing. The duration of this phase depends on the complexity of features and functionalities required for your fintech solution.

Following development, thorough testing is crucial to ensure that all components work seamlessly and meet quality standards. Testing may involve functional testing, performance testing, security testing, and user acceptance testing. The duration of this phase depends on factors such as the size of the application and its complexity.

After successful testing and quality assurance processes are completed, deployment takes place. This involves setting up servers, configuring databases, deploying code to production environments, and ensuring smooth integration with existing systems if necessary.

It’s important to note that developing a fintech solution is an iterative process that often requires updates and improvements based on user feedback or changing market demands. Therefore, post-deployment maintenance and support are also critical considerations in terms of ongoing updates and bug fixes.

In summary, while there is no fixed timeframe for developing a custom fintech solution due to its unique nature, it typically takes several months to over a year to complete from initial planning to deployment. Collaboration with an experienced development team will help ensure efficient execution within your desired timeline while maintaining high-quality standards.

What technologies do you use for developing fintech solutions?

Cloud Computing: Cloud computing is an essential technology for fintech solutions, allowing for scalability, reliability, and cost-effectiveness when developing and deploying applications.

Big Data & Analytics: Big data and analytics enable fintech solutions to collect, analyze, and process large amounts of data quickly to make informed decisions.

Artificial Intelligence (AI): AI technologies such as machine learning and natural language processing can be used to automate tasks like customer service, fraud detection, risk management, and more.

Blockchain: Blockchain technology is used in fintech solutions to provide secure transactions with improved transparency and traceability.

Mobile Technology: Mobile technology enables customers to access financial services on the go through their mobile devices or wearables.

6. Internet of Things (IoT): IoT devices can be used to collect data from connected devices such as sensors or wearables that can then be used in financial applications for better decision-making.

Do you provide ongoing maintenance and support for developed solutions?

Yes, as a fintech software development company, we understand the importance of providing ongoing maintenance and support for the solutions we develop. We believe that our relationship with clients extends beyond the initial development phase, and we are committed to ensuring that our solutions continue to perform optimally and meet your evolving needs.

Our team of dedicated professionals is available to provide ongoing support and maintenance services for the solutions we deliver. We offer various levels of support packages tailored to your specific requirements. Whether you need assistance with bug fixes, updates, security patches, or general troubleshooting, our team is here to help.

We prioritize proactive monitoring and regular maintenance to ensure that your fintech solutions remain secure, stable, and up-to-date. We stay abreast of industry trends and technological advancements so that we can provide timely updates and enhancements when necessary.

Additionally, we understand that technology evolves rapidly, and your business requirements may change over time. Our team is equipped to handle any modifications or enhancements you may require for your fintech solution. We work closely with you to understand your evolving needs and implement changes accordingly.

Our commitment to ongoing maintenance and support extends beyond mere technical assistance. We value open communication with our clients and strive to build long-term partnerships based on trust and collaboration. Our team is responsive, approachable, and dedicated to resolving any issues or concerns you may have promptly.

In summary, as a fintech software development company, we provide comprehensive ongoing maintenance and support services for the solutions we develop. From technical assistance to updates and enhancements, our goal is to ensure that your fintech solution remains robust, secure, and aligned with your business objectives.

Are there any additional fees or charges associated with the development process?

The presence of additional fees or charges in the development process can vary depending on the specific agreements and terms set between the fintech software development company and their clients. It is essential to have clear communication and a transparent understanding of the project scope, requirements, and pricing structure before entering into any contract.

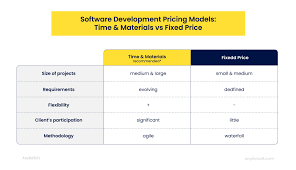

While some fintech software development companies may offer fixed-price contracts where all costs are included upfront, others may work on a time and materials basis. In such cases, additional fees may be incurred if there are changes or additions to the original project requirements.

Some common factors that could lead to additional charges include:

- Scope changes: If there are changes or additions to the initial project scope, it may require extra time and resources from the development team. This could result in additional fees, as the original agreement may have been based on a specific set of requirements.

- Third-party integrations: If your project requires integration with third-party services or APIs, there might be licensing or usage fees associated with those integrations. These costs are typically passed on to the client.

- Maintenance and support: After the development phase is complete, ongoing maintenance and support services may be required. These services often come with an associated cost, which can vary depending on factors such as the level of support required and the complexity of the software.

It’s crucial to discuss these potential additional fees upfront during contract negotiations to avoid any surprises later on. A reputable fintech software development company will provide you with a comprehensive breakdown of all costs involved in your project before starting development.

Remember, open communication and clarity regarding pricing structures and potential additional charges will help ensure a smooth development process while minimizing any unexpected financial implications along the way.

Can I see some examples of successful projects that have been completed by your team?

Yes, absolutely. We have completed a number of successful projects for our clients in the past. Here are a few examples:

– Developed an e-commerce platform for a client in the retail industry

– Built a web application for a client in the healthcare industry

– Developed an AI-powered chatbot for a client in the finance industry

– Created an interactive mobile game for a client in the gaming industry

– Implemented an automation system for a client in the manufacturing industry