Financial Software Development: Streamlining Financial Operations

In today’s fast-paced and ever-evolving financial landscape, the need for efficient and reliable financial software has become paramount. Financial institutions, businesses, and individuals alike are increasingly relying on technology to streamline their financial operations, improve accuracy, and enhance decision-making processes. This is where financial software development comes into play.

Financial software development refers to the process of creating customized software solutions specifically designed to meet the unique needs of the finance industry. These solutions encompass a wide range of applications, including accounting systems, payment processing platforms, risk management tools, investment analysis software, and more.

One of the key advantages of financial software development is its ability to automate complex financial tasks. Manual processes that were once time-consuming and error-prone can now be streamlined through sophisticated algorithms and intelligent automation. This not only saves time but also reduces human error, ensuring greater accuracy in financial calculations and reporting.

Another significant benefit of financial software development is its ability to provide real-time insights into financial data. With advanced analytics capabilities integrated into these solutions, users can access up-to-date information on cash flows, revenue streams, expenses, investments, and more. This empowers businesses and individuals to make informed decisions promptly based on accurate financial data.

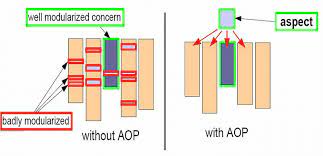

Furthermore, security is a critical aspect of any financial operation. Custom-built financial software solutions prioritize robust security measures to protect sensitive data from breaches or unauthorized access. Encryption protocols, multi-factor authentication mechanisms, and compliance with industry regulations are some of the safeguards implemented in these systems to ensure data integrity and confidentiality.

Financial software development also enables seamless integration with existing systems or third-party platforms via APIs (Application Programming Interfaces). This means that organizations can leverage their current infrastructure while adding new functionalities tailored to their specific requirements. Whether it’s integrating with banking systems for transaction processing or connecting with external market data providers for real-time market updates – custom-built financial software can be seamlessly integrated into existing workflows.

Moreover, financial software development is not limited to large financial institutions. Small and medium-sized businesses can also benefit from tailored solutions that cater to their unique needs and budget constraints. From basic accounting software to comprehensive enterprise resource planning (ERP) systems, there are customizable options available for businesses of all sizes.

In conclusion, financial software development plays a crucial role in revolutionizing the way financial operations are conducted. By automating complex tasks, providing real-time insights, ensuring robust security measures, and enabling seamless integration, these solutions empower organizations and individuals to optimize their financial processes. As the finance industry continues to evolve, custom-built financial software will undoubtedly remain a vital tool for efficiency, accuracy, and informed decision-making in the digital age.

5 Essential Tips for Successful Financial Software Development

- Understand the fundamentals of financial software development and how it relates to the current market trends.

- Stay up-to-date with the latest technologies and tools used in financial software development.

- Develop a strong understanding of user experience design principles to ensure your software meets customer needs and expectations.

- Utilize automated testing strategies to ensure your code is bug-free and secure before releasing it into production environments.

- Take advantage of cloud computing services for scalability, security, cost savings, and faster time-to-market for new features or products.

Understand the fundamentals of financial software development and how it relates to the current market trends.

Understanding the Fundamentals of Financial Software Development in Today’s Market

In today’s rapidly evolving financial landscape, staying ahead of the curve requires a deep understanding of financial software development and its relationship to current market trends. This tip highlights the importance of grasping the fundamentals of this field and how it can benefit businesses and individuals alike.

Financial software development encompasses the creation and customization of software solutions tailored specifically for the finance industry. It involves developing applications that automate financial tasks, provide real-time insights, ensure data security, and integrate seamlessly with existing systems. By understanding these fundamentals, businesses can leverage technology to optimize their financial operations.

One key aspect is automation. Financial software development enables businesses to automate complex financial processes that were once time-consuming and prone to human error. By implementing intelligent algorithms and automation tools, organizations can streamline tasks such as accounting, payment processing, risk management, and investment analysis. This not only saves time but also enhances accuracy in financial calculations and reporting.

Real-time insights are another crucial element. With advanced analytics capabilities integrated into financial software solutions, users gain access to up-to-date information on cash flows, revenue streams, expenses, investments, and more. This empowers businesses to make informed decisions promptly based on accurate financial data. Staying informed about market trends and changes becomes easier with real-time insights at hand.

Data security is paramount in today’s digital age. Financial software development prioritizes robust security measures to protect sensitive data from breaches or unauthorized access. Encryption protocols, multi-factor authentication mechanisms, and compliance with industry regulations are implemented to ensure data integrity and confidentiality. Understanding these security measures is essential for safeguarding valuable financial information.

Seamless integration is another vital aspect of financial software development. Custom-built solutions can be seamlessly integrated with existing systems or third-party platforms through APIs (Application Programming Interfaces). This allows organizations to leverage their current infrastructure while adding new functionalities tailored to their specific requirements. Being aware of integration capabilities enables businesses to enhance their workflows without disrupting existing operations.

Lastly, understanding how financial software development relates to current market trends is crucial. The finance industry is continuously evolving, with emerging technologies and changing customer demands shaping the landscape. Staying informed about market trends helps businesses identify opportunities and adapt their financial software solutions accordingly. Whether it’s incorporating machine learning algorithms for predictive analytics or integrating blockchain technology for secure transactions, aligning software development with market trends can provide a competitive edge.

In conclusion, understanding the fundamentals of financial software development and its relationship to current market trends is essential for businesses and individuals seeking to optimize their financial operations. By embracing automation, real-time insights, data security measures, seamless integration, and staying informed about market trends, organizations can leverage technology to streamline processes, make informed decisions promptly, and stay ahead in the dynamic world of finance.

Stay up-to-date with the latest technologies and tools used in financial software development.

Financial software development is an ever-evolving field that requires developers to stay up-to-date with the latest technologies and tools. With the rapid advancement of technology, financial software developers must be able to adapt and use the latest tools to ensure their applications are secure, efficient, and up-to-date.

Staying up-to-date on the latest technologies and tools used in financial software development is essential for any developer. This includes being aware of new programming languages, frameworks, libraries, and APIs that can be used to create secure and efficient applications. Additionally, developers should take the time to learn about security protocols and best practices for designing applications that protect user data.

Keeping up with the latest trends in financial software development also requires developers to stay informed on industry news and updates. This includes reading blogs, attending conferences, or taking courses related to financial software development. Doing so will help developers stay ahead of the curve when it comes to new technologies or security protocols that could affect their applications.

Finally, financial software developers should make sure they are familiar with existing tools and technologies as well as staying informed on new ones. By doing this, they can ensure their applications remain secure and efficient while taking advantage of any new features or capabilities offered by newer tools and technologies.

Overall, staying up-to-date with the latest technologies and tools used in financial software development is essential for any developer who wants to create secure and efficient applications. By staying informed on industry news and updates as well as becoming familiar with existing tools and technologies, developers can ensure their applications remain competitive in an ever-evolving market.

Develop a strong understanding of user experience design principles to ensure your software meets customer needs and expectations.

Developing a Strong User Experience in Financial Software Development

In the realm of financial software development, creating a product that meets customer needs and expectations is paramount. One key way to achieve this is by developing a strong understanding of user experience (UX) design principles. UX design focuses on enhancing user satisfaction by improving the usability, accessibility, and overall enjoyment of a software application.

When it comes to financial software, customers expect intuitive interfaces, easy navigation, and seamless interactions. They want an application that simplifies complex financial tasks and provides a pleasant user experience. By prioritizing UX design principles during the development process, you can ensure that your software not only meets but exceeds customer expectations.

Firstly, understanding your target audience is crucial. Conduct thorough research to identify their needs, pain points, and preferences. This knowledge will guide your decision-making process throughout the development cycle. By empathizing with your users’ goals and challenges, you can create a software solution that addresses their specific requirements effectively.

Next, focus on designing an intuitive user interface (UI). A clean and organized layout with logical workflows will enable users to navigate through the application effortlessly. Minimize clutter and prioritize essential features to avoid overwhelming users with unnecessary information or options.

Consistency is another key aspect of UX design. Ensure that your financial software follows established industry standards and conventions. Consistent terminology, visual cues, and interaction patterns build familiarity and reduce cognitive load for users. This consistency across different sections of the software creates a cohesive experience that enhances usability.

Efficiency should also be at the forefront of UX design in financial software development. Users expect streamlined processes that save them time and effort. Incorporate features like auto-fill forms or pre-filled templates to expedite data entry tasks. Additionally, provide clear instructions or tooltips to guide users through complex processes or calculations.

Accessibility is vital in ensuring inclusivity within financial software applications. Consider diverse user needs such as color blindness or screen reader compatibility. Adhere to accessibility guidelines and standards to ensure that your software can be used by individuals with varying abilities.

Lastly, continuously gather user feedback and iterate on your design. Conduct usability testing sessions to observe how users interact with your software and identify areas for improvement. User feedback is invaluable in refining your application and aligning it more closely with customer expectations.

In conclusion, developing a strong understanding of user experience design principles is essential for creating financial software that meets customer needs and expectations. By empathizing with users, designing intuitive interfaces, maintaining consistency, prioritizing efficiency, ensuring accessibility, and incorporating user feedback, you can deliver a financial software solution that not only fulfills its functional requirements but also provides an exceptional user experience.

Utilize automated testing strategies to ensure your code is bug-free and secure before releasing it into production environments.

Utilize Automated Testing Strategies for Bug-Free and Secure Financial Software Development

In the realm of financial software development, ensuring that your code is bug-free and secure is of utmost importance. One effective strategy to achieve this is by utilizing automated testing. By implementing automated testing strategies, you can thoroughly evaluate your code before releasing it into production environments, mitigating potential risks and enhancing the overall quality of your financial software.

Automated testing involves the use of specialized tools and scripts to execute predefined test cases, simulate various scenarios, and analyze the results. This method offers several advantages over manual testing, such as increased efficiency, accuracy, and repeatability. Let’s explore how automated testing can benefit financial software development.

Firstly, automated testing significantly reduces the chances of human error. Manual testing can be time-consuming and prone to oversight due to human limitations. With automated tests in place, you can ensure that every aspect of your code is thoroughly examined. From validating inputs and outputs to stress-testing performance under different conditions, automated tests leave no room for human oversight or negligence.

Secondly, automation allows for comprehensive test coverage. Financial software often involves complex calculations, intricate algorithms, and intricate data processing. Manually testing every possible scenario can be a daunting task. Automated tests can cover a wide range of scenarios efficiently and consistently. Whether it’s edge cases or unusual user inputs, automated tests ensure that your code performs as expected across various scenarios.

Moreover, security is a critical concern in financial software development. Automated security testing tools can scan your code for vulnerabilities such as potential security loopholes or weak encryption protocols before they are deployed into production environments. Identifying these issues early on enables you to address them promptly, reducing the risk of cyber-attacks or data breaches.

Furthermore, automation enables continuous integration and delivery (CI/CD) practices in financial software development processes. By automating the testing phase as part of your CI/CD pipeline, you can ensure that code changes are thoroughly tested before being deployed. This helps catch and fix bugs early on, preventing issues from reaching production environments and minimizing potential disruptions to financial operations.

In conclusion, utilizing automated testing strategies is crucial for bug-free and secure financial software development. By leveraging automation tools, you can enhance the efficiency, accuracy, and reliability of your testing processes. Automated tests leave no room for human error, provide comprehensive test coverage, identify security vulnerabilities, and enable seamless integration into CI/CD pipelines. Embracing automated testing practices empowers developers to deliver high-quality financial software that meets the stringent demands of the industry while minimizing risks in production environments.

Take advantage of cloud computing services for scalability, security, cost savings, and faster time-to-market for new features or products.

Unlocking the Benefits of Cloud Computing in Financial Software Development

In the realm of financial software development, staying ahead of the curve is essential. One tip that has proven to be a game-changer is harnessing the power of cloud computing services. By leveraging cloud technology, businesses can reap numerous benefits, including scalability, enhanced security, cost savings, and accelerated time-to-market for new features or products.

Scalability is a critical aspect of financial software development. As businesses grow and user demands evolve, the ability to scale resources quickly becomes paramount. Cloud computing services offer flexible infrastructure that can easily accommodate fluctuating workloads. Whether you need to handle increased transaction volumes during peak periods or scale down during quieter times, cloud platforms provide the necessary agility without compromising performance or incurring unnecessary costs.

Security is another crucial concern in the financial industry. With sensitive data at stake, maintaining robust security measures is non-negotiable. Cloud service providers invest heavily in advanced security protocols and technologies to protect their infrastructure and customer data. By migrating financial software systems to reputable cloud platforms, businesses can leverage these robust security measures, ensuring data integrity and confidentiality.

Cost savings are a significant advantage offered by cloud computing services. Traditional on-premises infrastructure requires substantial upfront investments in hardware, software licenses, maintenance, and skilled IT personnel. On the other hand, cloud platforms operate on a pay-as-you-go model where businesses only pay for the resources they consume. This eliminates capital expenditures while providing predictable monthly costs based on actual usage.

Additionally, cloud computing enables faster time-to-market for new features or products in financial software development. Traditional software deployment often involves lengthy setup processes and manual configurations that can delay product releases or updates. Cloud-based solutions offer pre-configured environments and automated deployment pipelines that streamline these processes significantly. This allows developers to focus more on innovation rather than infrastructure management, resulting in faster delivery cycles.

Furthermore, cloud platforms provide access to a vast array of managed services and tools that can enhance the functionality and performance of financial software. From machine learning capabilities for fraud detection to real-time analytics for data-driven decision-making, cloud services offer a wide range of features that can be integrated seamlessly into financial software applications.

In conclusion, embracing cloud computing services is a valuable tip for businesses engaged in financial software development. The scalability, enhanced security, cost savings, and accelerated time-to-market provided by cloud platforms empower organizations to stay competitive in a rapidly evolving industry. By leveraging these benefits, businesses can optimize their financial software solutions while focusing on innovation and meeting the ever-changing needs of their customers.